reit dividend tax philippines

In the case of OFWs the exemption will remain for a period of seven years from. However to-date no REITs have been launched due to two major hurdles that developers have not been willing to accept.

Are Reits Finally About To Take Off In The Philippines Magazine Reit Asiapac

REIT legislation was passed in the Philippines ten years ago.

. 14 of Republic Act No. Gross Income as defined under Section 32 of the NIRC Less. The REIT Act of 2009 however allows such dividend distribution to be deducted from a REITs taxable income.

REIT investing comes with tax benefits. Cash dividends paid out by companies listed at the Philippine Stock Exchange to common shareholders improved by 173 percent to P40218 billion in 2021 from 2020s P34288 billion boosted by. In some cases you might owe capital gains tax on some REIT ETF earnings which will be noted on Form 1099-DIV.

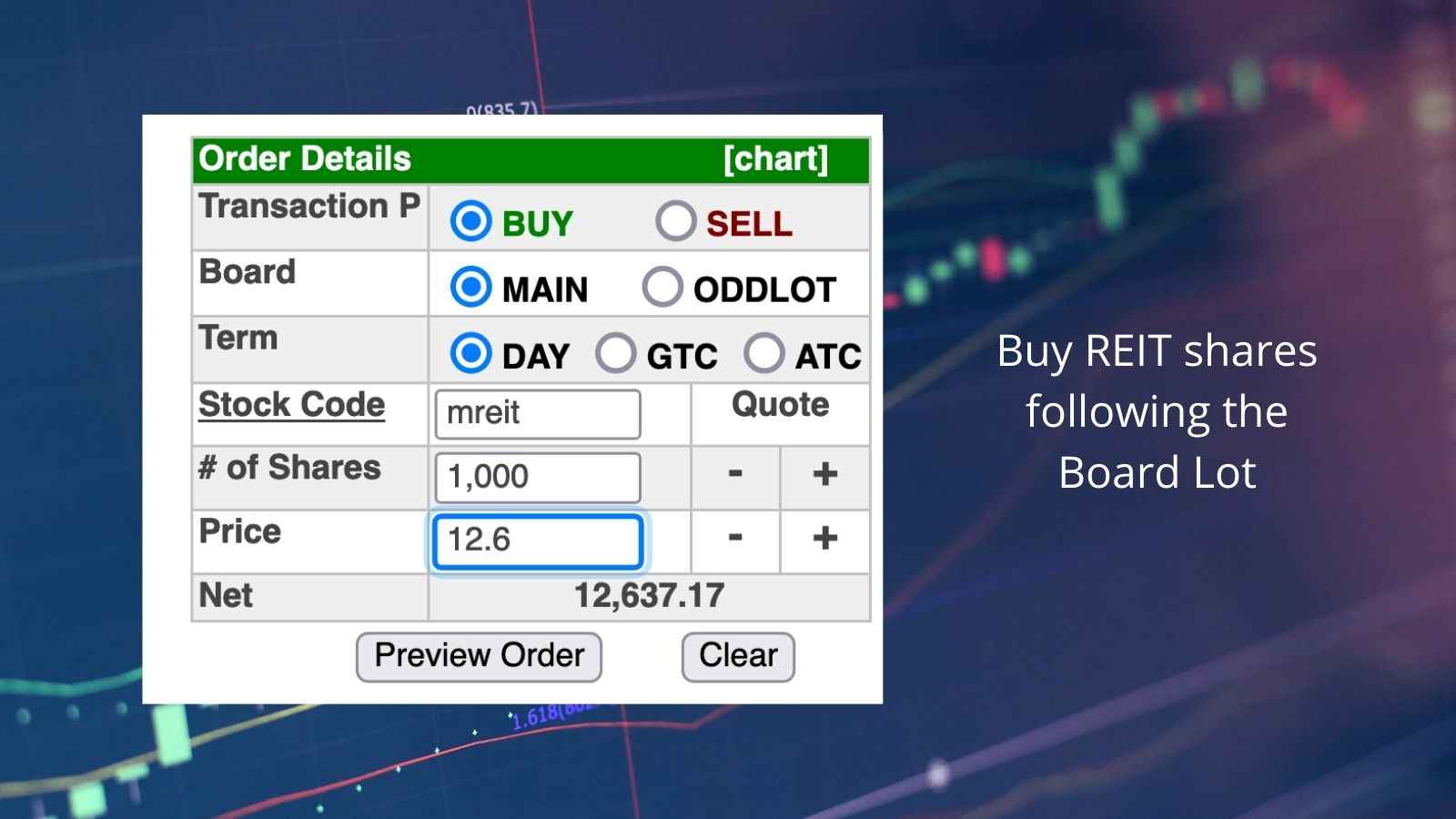

The shares of a REIT company can be bought through any of the local stock brokers and traded in the Philippine Stock Exchange. Bureau the income tax collectible from the REIT on the dividend it declared and deducted from its taxable income as well as the 50 documentary stamp tax given as incentive on the transfer of real property to REIT in light of the reduced minimum public ownership requirement and in the spirit of ease of doing business. Below are the listed REIT in the Philippine Stock Exchange.

Initial Public Offering of the company on Philippine Stock Exchange was August 13 2020. Dividends received by nonresident alien individuals or nonresident foreign corporations are subject to the preferential withholding tax rate of less than ten percent 10 pursuant to an applicable tax treaty. A blueprint for building the nation.

You May Avail Tax Perks with REIT Investments. As of this Writing. Simply put a Philippine Real Estate Investment Trust or Philippine REIT is a corporation primarily engaged in owning income-generating real estate properties.

Allowable Deductions as provided under Section 34 whether itemized or Optional Standard Deduction Dividends Paid as defined under these Regulations Taxable Net Income x 30 Income Tax Due. In general dividends paid by the REIT will be subject to a final tax of 10 unless paid to a domestic or resident foreign corporation or an overseas Filipino investor OFW. Of the Philippines SCCP fee of 01 12 VAT of the commission and sales tax of 006 when selling shares.

Since REITs are obliged by law to maintain 33 of the companys share to be owned by public investors and distribute a minimum of 90 of their taxable income to shareholders in the form of dividends wealth is diversified. The remaining 060 comes from depreciation and. Promised many things from bringing the price of rice to P20 per kilo from nearly P40 at.

Yes because REITs are traded on the Philippine Stock Exchange PSE. AREIT Ayala Land REIT Inc It is the first REIT in the Philippines. The REIT generates 2 per unit from operations and distributes 90 or 180 to unitholders.

Company must invest only in. REIT fees include a commission fee of 25 of the gross trade 005 PSE Transaction Fee Securities Clearing Corp. REITs boost cash dividend payouts of listed firms.

The Reit is also exempt from tax on its rental income which it may have earned if it owned a property directly. They found public ownership level prescribed and application of the 12 value-added VAT tax on the transfer of properties to REITs. The interest and dividends received by the ReitInvIT from the SPVs is exempt from tax.

How to Invest in Fixed Income Securities in the Philippines. Company must be listed in the Philippine Stock Exchange PSE and distribute dividends of at least 90 of its net income. Most REIT ETF dividends will be taxed at your ordinary income tax rate after the 20 qualified business income deduction is applied to those distributions.

Firstly a 12 property transfer tax and secondly a 67 required Minimum Public Ownership MPO. Cash or property dividend paid by a Philippine REIT shall be subject to the regular final withholding tax of ten percent 10 except in the following cases. Dividends issued to a Filipino individual or resident alien are taxed at 10 while dividends issued to domestic and foreign-resident corporations are exempted from the tax.

In computing the income tax due of a REIT the formula to be used shall be as follows. The tax exemption for overseas Filipinos who receive dividends from REITs was contained in the REIT Act of 2009. In the Philippines only in September 2009 that The House of Representatives and Senate respectively approved the REIT Act.

Of this 120 of the dividend comes from earnings. However REIT was not fairly accepted by the big players in the real estate industry. Generally dividends distributed from retained earnings or post-tax income is not a deductible expense for tax purpose.

More so for OFWs who invest in Philippine REITs as theyre exempted from paying the 10 income tax or withholding tax on dividends for seven years starting from January 20 2020. 9856 OFWs are exempted from paying the 10 percent dividend tax for seven years beginning January 2020. In order to qualify for tax exemptions under the REIT Act companies must first meet the following requirements.

The law also mandates REITs to declare as dividends at least 90 percent of its distributable income. The tax regulations were issued during the term of Revenue Commissioner Kim Jacinto. A REIT-specific corporation will distribute 90 of its income to its shareholders the remaining 10 income will be the only one left to receive the 30 tax.

Amount of Cash Dividend Per Share. The main difference between a REIT and a non-REIT publicly.

Reits The Less Volatile Investment Manila Bulletin

Areit Should You Buy The Stock Of Ayala Reit Pinoy Money Talk

Real Estate Investment Trusts Reits The Next Big Thing In Real Estate Foreclosurephilippines Com

Upcoming Reit Dividends This September 2021 Reit Philippines

Philippines Tax Talk Understanding The Reit Act Incorp Philippines

Areit Should You Buy The Stock Of Ayala Reit Pinoy Money Talk

Solved Final Tax Rates Write The Final Tax Rate Applicable For Each Income If It Is Exempt Write Ex If It Is Subject To Other Income Tax Schemes Course Hero

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof Nasdaq

Upcoming Reit Dividends This September 2021 Reit Philippines

How To Invest In Reits In The Philippines In 2022

Gsis Sss Dividend Gains On Areit Ddmp Reit

Implementing Rules And Regulations Of The Real Estate Investment Trust Reit Act Of 2009 Reit Philippines

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Reits The Less Volatile Investment Manila Bulletin

Tax On Dividend Income In The Philippines 2020 Kg Consult Group Inc

India Implications Of The Finance Bill 2020 On Invits Reits And Its Unitholders Conventus Law